Brought to you and to the world by

from Ed

from Ed

email me to discuss things publisher@globalbusiness.media

see my channel on youtube youtube.com/@globaltvtalkshow

subscribe (free) if you like it

Welcome to

GLOBAL BUSINESS

IQ

Included are charts/graphs + interesting video chats I really enjoy.

I love FEEDBACK so please tell me what you think of this publication as a resource for things you likely have not thought about recently.

1:1

Tatyana St. Germain

1:1 Zurich-based ANGIE W

BECOMING A LEADER

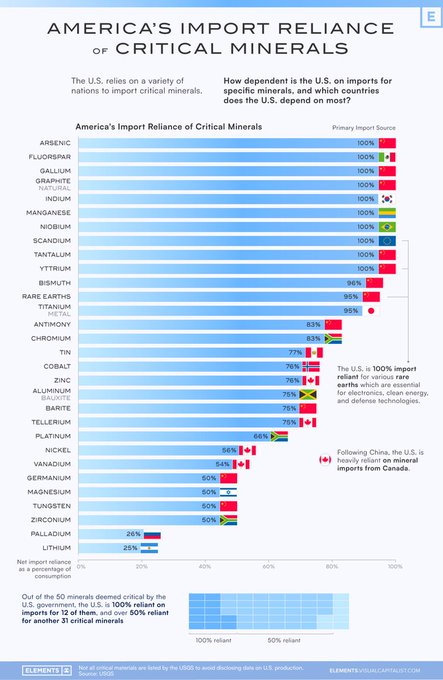

America’s Import Reliance of Key Minerals

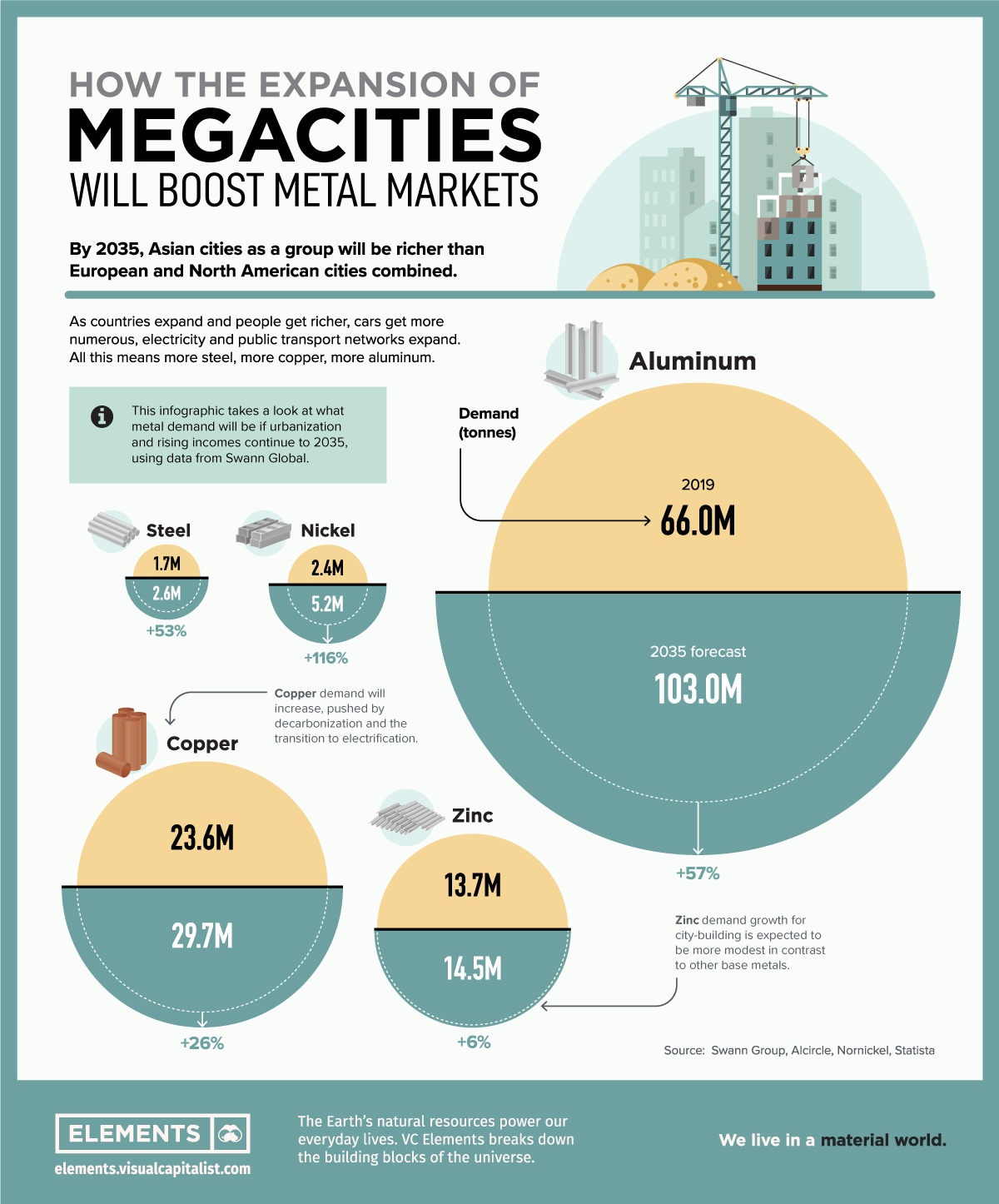

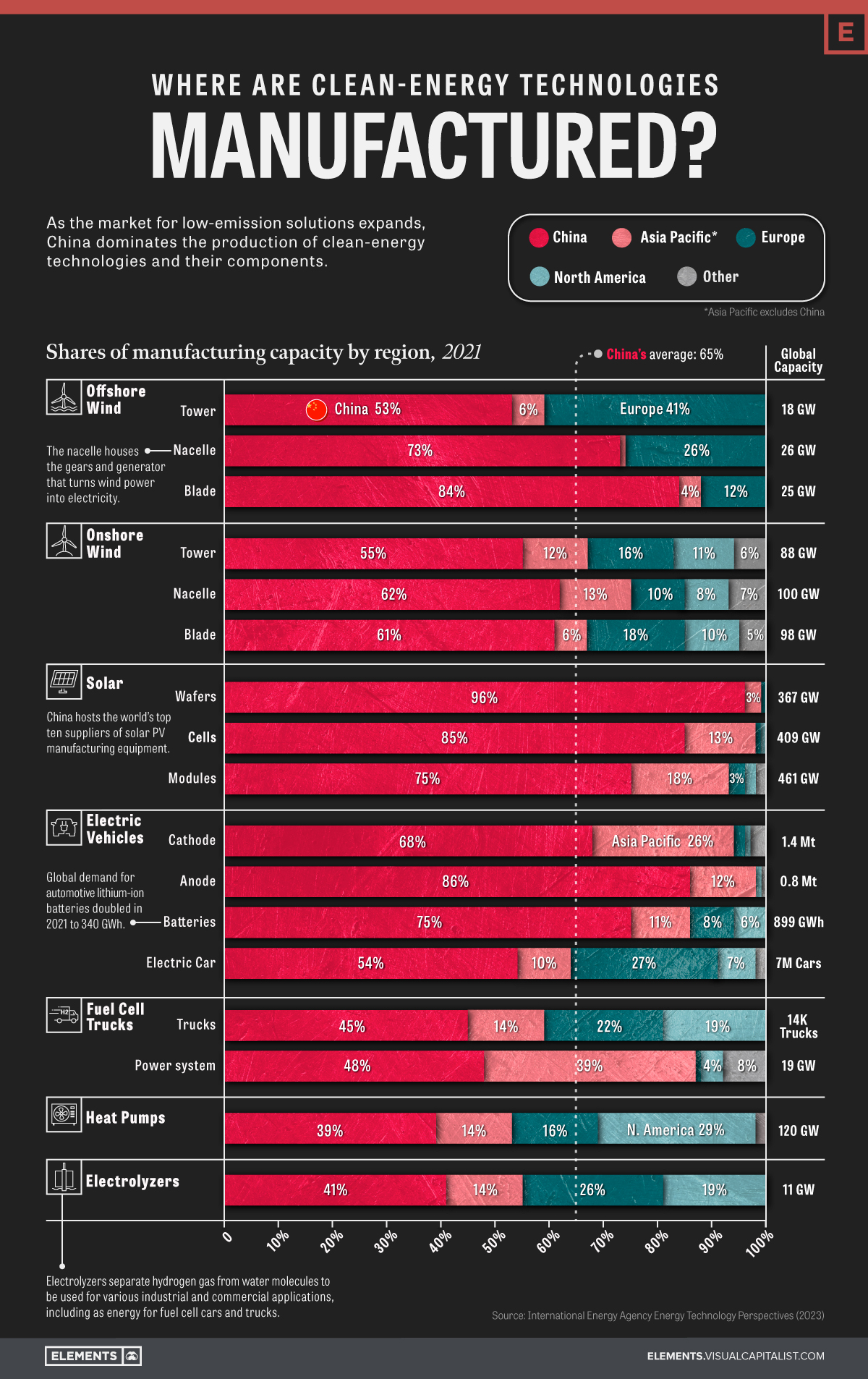

The push towards a more sustainable future requires various key minerals to build the infrastructure of the green economy. However, the U.S. is heavily reliant on nonfuel mineral imports causing potential vulnerabilities in the nation’s supply chains.

Specifically, the U.S. is 100% reliant on imports for at least 12 key minerals deemed critical by the government, with China being the primary import source for many of these along with many other critical minerals.

This graphic uses data from the U.S. Geological Survey (USGS) to visualize America’s import dependence for 30 different key nonfuel minerals along with the nation that the U.S. primarily imports each mineral from.

U.S. Import Reliance, by Mineral

While the U.S. mines and processes a significant amount of minerals domestically, in 2022 imports still accounted for more than half of the country’s consumption of 51 nonfuel minerals. The USGS calculates a net import reliance as a percentage of apparent consumption, showing how much of U.S. demand for each mineral is met through imports.

Of the most important minerals deemed by the USGS, the U.S. was 95% or more reliant on imports for 13 different minerals, with China being the primary import source for more than half of these.

| Mineral | Net Import Reliance as Percentage of Consumption | Primary Import Source (2018-2021) |

|---|---|---|

| Arsenic | 100% | China |

| Fluorspar | 100% | Mexico |

| Gallium | 100% | China |

| Graphite (natural) | 100% | China |

| Indium | 100% | Republic of Korea |

| Manganese | 100% | Gabon |

| Niobium | 100% | Brazil |

| Scandium | 100% | Europe |

| Tantalum | 100% | China |

| Yttrium | 100% | China |

| Bismuth | 96% | China |

| Rare Earths (compounds and metals) | 95% | China |

| Titanium (metal) | 95% | Japan |

| Antimony | 83% | China |

| Chromium | 83% | South Africa |

| Tin | 77% | Peru |

| Cobalt | 76% | Norway |

| Zinc | 76% | Canada |

| Aluminum (bauxite) | 75% | Jamaica |

| Barite | 75% | China |

| Tellerium | 75% | Canada |

| Platinum | 66% | South Africa |

| Nickel | 56% | Canada |

| Vanadium | 54% | Canada |

| Germanium | 50% | China |

| Magnesium | 50% | Israel |

| Tungsten | 50% | China |

| Zirconium | 50% | South Africa |

| Palladium | 26% | Russia |

| Lithium | 25% | Argentina |

These include rare earths (a group of 17 nearly indistinguishable heavy metals with similar properties) which are essential in technology, high-powered magnets, electronics, and industry, along with natural graphite which is found in lithium-ion batteries.

These are all on the U.S. government’s critical mineral list which has a total of 50 minerals, and the U.S. is 50% or more import reliant for 43 of these minerals.

Some other minerals on the official list which the U.S. is 100% reliant on imports for are arsenic, fluorspar, indium, manganese, niobium, and tantalum, which are used in a variety of applications like the production of alloys and semiconductors along with the manufacturing of electronic components like LCD screens and capacitors.

China’s Gallium and Germanium Restrictions

America’s dependence on imports for various minerals has resulted in a new challenge resulting from China’s announced export restrictions on gallium and germanium that took effect August 1st, 2023. The U.S. is 100% import dependent for gallium and 50% import dependent for germanium.

These restrictions are seen as a retaliation against U.S. and EU sanctions on China which have restricted the export of chips and chipmaking equipment.

Both gallium and germanium are used in the production of transistors and semiconductors along with solar panels and cells, and these export restrictions present an additional hurdle for critical U.S. supply chains of various technologies that include LED lights and fiber-optic systems used for high-speed data transmission.

The restrictions also affect the European Union, which imports 71% of its gallium and 45% of its germanium from China. It’s another stark reminder to the world of China’s dominance in the production and processing of many key minerals.

The announcement of these restrictions has only highlighted the importance for the U.S. and other nations to reduce import dependence and diversify supply chains of key minerals and technologies.

Emily M. Dickens, SHRM Chief of Staff,

Head of Public Affairs & Corporate Secretary,

Responds to President Biden’s State of the Union

ALEXANDRIA, Va – Emily M. Dickens, SHRM Chief of Staff, Head of Public Affairs & Corporate Secretary, issued the following statement in response to President Biden’s 2024 State of the Union address:

“SHRM is guided by the principle of Policy, Not Politics.

Accordingly, SHRM views the State of the Union address as an opportunity to focus on critical policy issues facing work, workers and workplaces.

This important policy event reminds us about the deep responsibility of governance and a return to civility.”

President Biden called attention to several of the issues important to SHRM members in his 2024 State of the Union speech, including:

Workforce Development –

- The President underscored the need to prepare more Americans for the jobs of the future.

- SHRM research found that 65 percent of HR professionals report that their organization has been dealing with labor shortages in the past year, and 58 percent had trouble finding qualified applicants.

- SHRM urges Congress to enact policies that promote skills-based hiring that harnesses untapped talent pipelines, such as veterans, military spouses, caregivers and people without four-year degrees.

- Several bipartisan bills such as A Stronger Workforce for America Act and The Bipartisan Workforce Pell Act would support skills-based hiring.

- SHRM also advocates for the expansion of apprenticeships, a valuable tool for developing a skilled workforce and closing the skills gap.

Paid Leave –

- The President shined a spotlight on the need for paid leave policies that reflect the modern world of work. The 30th anniversary of the FMLA created an opportunity for Congress to expand access to paid leave to more workers, provide flexibility to employers in program design and increase regulatory consistency for multistate employers.

- Congress should consider our proposal to create a voluntary federal insurance market that allows employers to fund paid leave benefits by tapping into pooled resources.

Artificial Intelligence (AI) –

- The President made clear the need to harness the potential of AI and alleviate its risks. We see a future where the synergy of artificial and human intelligence (HI) paves the way for a workforce that is not only efficient but truly empowered.

- When combined with HI, AI can transform organizations while maximizing human potential. AI + HI = ROI.

- A quarter of HR departments already use AI applications for specific purposes such as recruitment and employee training and development.

- By 2025, we expect that 50 percent of HR departments could be using AI.

- We urge Congress to enact legislation that supports, rather than stifles, workplace and workforce innovation through AI and ensures a level playing field for employees and employers.

“SHRM stands ready to work with President Biden and Congress to promote public policy that ensures that people and businesses thrive together.

SHRM is committed to fostering a civil and productive work environment across the nation, advocating for policy solutions over political agendas.

U.S. workers themselves, as highlighted in the SHRM State of the Workplace report, identified civility as a crucial element for organizational effectiveness.

This belief inspired the launch of the SHRM Civility Campaign, urging both workplaces and Congress to prioritize respectful communication and collaboration.

By promoting civil discourse, we believe disagreements can be addressed constructively, paving the way for a more productive and positive work experience for all.”

About SHRM

SHRM is a member-driven catalyst for creating better workplaces where people and businesses thrive together.

As the trusted authority on all things work, SHRM is the foremost expert, researcher, advocate, and thought leader on issues and innovations impacting today’s evolving workplaces.

With nearly 340,000 members in 180 countries, SHRM touches the lives of more than 362 million workers and their families globally. Discover more at SHRM.org.

V

A

R

I

E

T

Y

for our diverse audience

from across time/space,

from across borders/cultures,

from across industries/silos

people

places

topics

Rob Pianka, Global Agility https://youtu.be/MJQQrqo5FK4

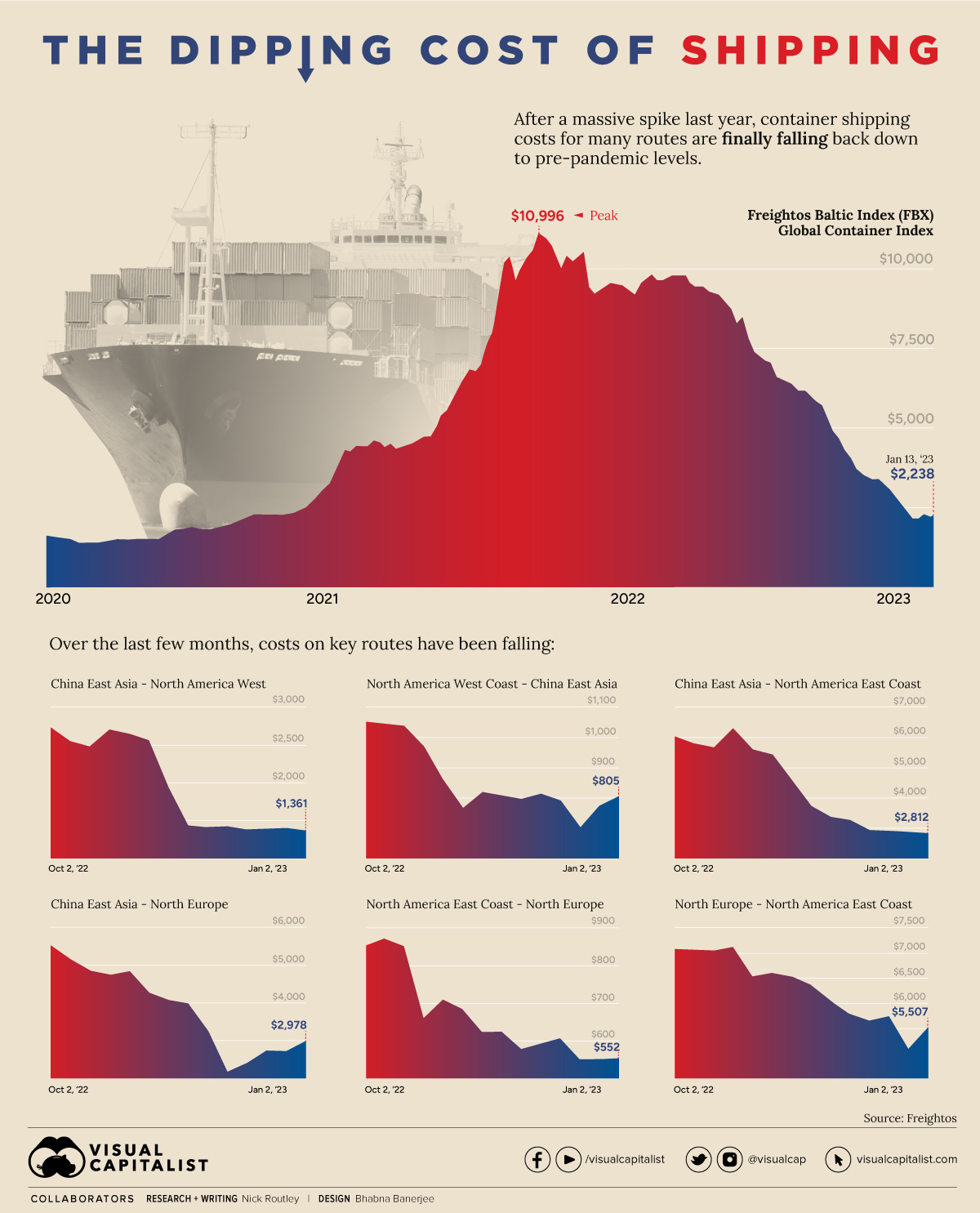

International Shipping,1:1 with Alex Talbot https://youtu.be/IFvMjmiA2Ks

Larry Kruger CustomizedMoving.com https://youtu.be/2eOZvMteqZE

Dr Natalie https://youtu.be/iNvjbMZJhnM;

pandemic of LOVE https://youtu.be/U5TdRRq4o64;

talent mobility https://youtu.be/juJWTJoTM6Y;

power of women https://youtu.be/scHq-lN6IAM;

London now? https://youtu.be/HhdO9AblUpU;

I got out of Moscow https://youtu.be/xvbveJZmTUM;

International Lifestyles https://youtu.be/cS_DNvCvveQ;

COMMUNICATORS https://youtu.be/rRDzeQUnyEM;

me…sexist ? https://youtu.be/hWzC0W0FoZs

1:1

Patricia Tavares

BRAZIL TALKS

1:1

DAVID EDICK Jr

on

WORLD AFFAIRS

geo-political economics

1:1 EXECUTIVE INTERVIEWS…

our specialty product.

See for yourself globaltvtalkshow.com

CONTACT me to discuss various options… all good.

Ed Cohen, Product Developer/Publisher/Broadcaster

voice/text (+1)619.787.3100 or email publisher@globalbusiness.media

click logo

click logo