COMING SOON IN THIS SPACE:

NEWS TICKER

… COMPANY NEWS … INDUSTRY NEWS … LEADERSHIP NEWS …

COSPONSOR NEWS TICKER …

EVERYONE WILL SEE YOUR MESSAGING

Survey asked

HR professionals + U.S. workers

to select the

3

top priorities

they would like to see;

leadership and manager development

(41%)

employee experience

(37%)

learning/development

(25%)

CONTACT

Ed Cohen

Founder: Editor & Publisher / Producer / Broadcaster

+1) 619.787.3100 WhatsApp

Dateline

DUBLIN IRELAND

Have you checked out our

Domestic Trends Report

?

The latest in our continuing series of benchmarking research.

Thank you to all of the mobility leaders who participated in our survey and contributed to this report!

Click here to view: hubs.ly/Q0428mR40

AIRES was founded on the premise that inspired thinking fundamentally transforms the way businesses approach global mobility.

The best results are achieved with a model that brings together people, process, and technology.

For more information, click hubs.ly/Q02Slc5w0

Checking-in with GEN Z

-

-

We have worked together over many years, including in New York, London and beyond … internationally for sure.Ed continues to be something of a mentor to myself and my businesses.Insightful, progressive and highly focused, with a truly excellent global reach, I have no hesitation in highly recommending Ed to other entrepreneurs and business professionals.”

Provides services: Real Estate, Relocation, Commercial Real Estate, Property Management,Real Estate Marketing, Financial Analysis, Project Management

-

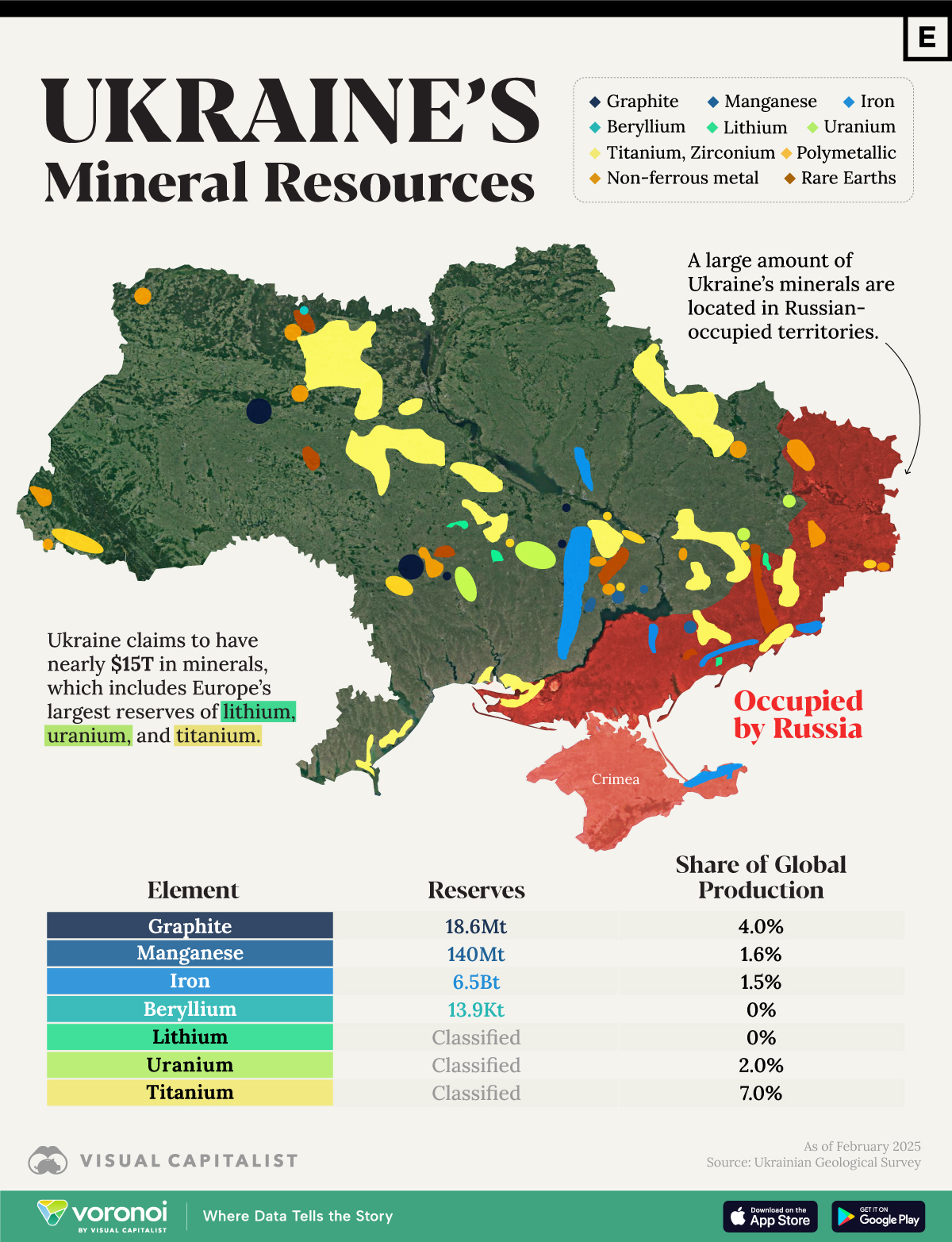

Dateline UKRAINE

Chris Exline, CEO, HOME ESSENTIALS, reporting; commentators STEVEN HOWARD, author on LEADERSHIP; and, Mexico City-based RIGOBERTO VASQUEZ, international business

Dateline

ZURICH, SWITZERLAND

You

Your Brand

Your message

SHOULD BE SEEN

BE HEARD

BE RECOGNIZED

4 WHAT YOU DO WELL

365/7-24 NONSTOP

place your message on

PAGE1

Yes, discuss … reach-out to the

EDITORglobalbusinessnews@gmail.com

… you will be glad you did it, promise!

IQ gets you hired; EQ gets you promoted…

Dateline

BARCELONA + STOCKHOLM

+ PHOENIX + L A

Mehibe in Barcelona

Atika in Stockholm

Steven in Phoenix

Ken in L A

Are you

PERFORMING

outside of your

COMFORT ZONE?

TO LIFE !

HERE’S TO YOUR HEALTH

TO YOUR WELLNESS

TO YOUR HAPPINESS

Medical Science Research

INTRODUCING

KEN LLOYD, PhD, author

PERSONAL

BRANDING

What is it?

Why is it important today?

How does it work?

APAC

… and did you know? Inside diplomatic circles it’s now called the

INDO-PACIFIC REGION

GlobalBusiness LatAm

WHO

WOULD YOU LIKE TO NOMINATE

to be recognized as a

COMMUNICATOR

?company

person?

SEND YOUR NOMINATIONS

TO

publisher@globalbusiness.media

See what we do to celebrate… Now tune-in… watch the 2024 ANNOUNCEMENTS

…audience worldwide via the GBNMEDIAnetwork anchored by YOUTUBE, by LINKEDIN, by GLOBALBusinessNews

HR leaders expect leadership training and employee engagement to be top priorities, a Society for Human Resource Management report found.

“As organizations continue to navigate talent shortages, economic fluctuations, and evolving workplace dynamics, HR leaders are shifting their focus to long-term workforce development and engagement strategies,” said Johnny C. Taylor, Jr., SHRM-SCP, president and CEO of SHRM.

“To thrive in today’s ever-evolving landscape, organizations must ensure the pace of change inside their businesses keeps up with or outpaces the change happening outside. Investing in strong leadership, employee experience, and learning and development will be key to driving business success in the year ahead.”

The survey asked HR professionals and U.S. workers to select the top three priorities they would like to see.

leadership and manager development (41%),

employee experience (37%),

learning/development (25%).

![]()

US CHIPS ACT

Economic Engine

Exclusive 1:1 presenting a key person involved with the Act’s development/writing; Rebecca Peters-Corley, Director, Semiconductor Public Policy at Samsung Electronics America. She is an active CHIPs, STEM and workforce advocate.

BRANDING:

Professional & Personal

———–

2025 PEOPLE PREDICTIONS

Dateline: UKRAINE

Chris Exline reporting

…..

PSYCHOLOGICAL SAFETY

in WORKPLACES;

office / on assignment / remote

Thank You! to

NYC Navigator, Avenue of the Americas

GLOBAL BUSINESS NEW YORK CONFERENCE

presented in-person March 13, 2024

MASTERMINDS

“international

women-in-business

and their allies“

REPATRIATION

Who benefits most?

Company, Assignee, Services

TALENT MASTERMINDS CONVENE

WORKPLACE CRISIS SITUATIONS …AND WHAT TO DO

1:1

Reiner Lomb Author/Coach

understanding

EMOTIONS … and USING them

1:1

ALOHA

Spirit Lives;

Let’s discuss EDUCATION for kiddos

CUSTOMER FEEDBACK

GLOBALTVtalkshow

Link here to our 30 min chat on Youtube:

https://lnkd.in/da-jvWDt

It was a stimulating conversation and I’m truly grateful and honoured for Ed’s invitation for me to go live with him in San Diego!

Looking forward to another session too… and I never thought I’d be able to say “I’m live with San Diego!”

Meeting people like Ed brings so much joy into my daily worklife and I hope that our discussion supports people to understand more about why courage is the powerhouse value for your personal confidence and leadership skin.

impostersyndrome, courageousleadership, selfconfidence, mindsetmatters

AUTHOR / LEADERSHIP COACH,

STEVEN HOWARD,

WHY / HOW

CEO’S MUST CHANGE ATTITUDES

IN THIS TRANSFORMATIVE ERA WE ARE WORKING IN… learn from

PaulFalconeHR

today discussing

DELEGATING

FEEDBACK

COACHING

MENTORING

CLICK and watch

1:1

Jack Jampel

Helping

People

1:1

Dr. Lynn Schmidt

BARBIE … here’s my take

1:1

Dr Simon T Bailey

SELF-HELP

1:1

Dianne Devitt

MEDIA

COACH

Joseph McGuire

Face Facts Author