GLOBAL LatAm edition8

Publisher’s Memo

Publisher’s Memo

Ed Cohen publisher@globalbusiness.media

I’m getting so much pleasure producing/developing this info-series.

Please forward this link to colleagues, customers, service-partners. Global Free Access 365-7-24.

CoSponsorship avail $100.

Show the world of business people your logo-link; become associated with this good info/guidance.

Thank You for your kind consideration.

Contact me today; discuss things.

Thought-Leaders

F&A, Global Mobility, International Tax, HR & Latam Payroll Professional

Passionate for Teamwork and “teach by learning and learn by teaching” approach. Focused on an employee experience based on a strong relationship with Stakeholders, COE and vendors involved, strong believer of continuous growth paved on empathy for all involved in the process.

Competences:

– Result Oriented – Empathic Communication – Bringer of Alternatives

– Vast Knowledge – Pondered Decision making – Focused on “Win-Win” relationships

– Resource maximization – Strategies’ implementation & modification – Teammates developer

previous editions

Global LatAm

GLOBAL-TVtalkshow

edition 5

edition 6

Ileana I. Ferber, MBA

-

-

Division accountability spans Acquisitions & Divestments, Exploration & New Ventures, and Guyana Development & Production Futures

Appointed to develop and iterate an Organizational Effectiveness Framework—including a “Design One, Build Many” methodology and intranet—to help ExxonMobil better deliver business results through the shared strengths of its leadership team and workforce.

Framework will become a sustainable, living, and repurposable document for the Guyana Enterprise—ultimately reimagining, testing, and standardizing culture, leadership pipeline, talent development, and team effectiveness across 9 internal business lines, 24 teams, and 570+ people, as well as 15 prime contractors and 60 suppliers across in 5 countries.

-

And now go deep… consider this info…

A tale of commodities:

How LatAm’s trade with countries has changed through the centuries.

Soy? Copper? Bovine Meat?

At the turn of the nineteent

Trade, or more specifically free trade, was a big one.

See, under the mercantile systems imposed by European empires throughout the 1700s and 1800s colonies could only trade with their colonial masters in the homeland. All raw goods from Spanish America, for example, had to be shipped to the ports of Seville or Cádiz in southern Spain.

Desiring to trade with other great powers (particularly the British), the soon-to-be Latin Americans declared independence. And the rest is history.

Trade has been just as important in the centuries since, if not more, as the newfound states in the region had to grow their economies and finance their development. Trade with Iberia was gradually supplanted by trade with the British and then the United States.

Which brings us to today.

China is without a doubt the most critical economy for a majority of Latin America’s biggest countries, serving as the primary trade partner of, among others, Brazil, Chile, Ecuador, Peru, and Uruguay.

China’s trade with Latin America has soared from $14B in 2000 to almost $500B in 2022, as our Senior Editor Gabriel Cohen recently outlined in a story for our good friends over at Americas Quarterly.

In the process, China has managed to surpass the European Union in terms of commercial relations with Latin America, swallowing up more Brazilian soy, Chilean copper, and Uruguayan beef than the supranational bloc headquartered in Brussels.

China might even have been able to become the region’s overall largest trade partner, if not for Mexico and its tight trade ties with the US. Last year, Mexico surpassed China to become Washington’s main trade partner. Both imports and exports are soaring between the North American countries, and while South America remains dependent upon China, Mexico’s economy is inextricably tied to its northern neighbor.

Without a doubt, trade is just as important for Latin America’s countries today as it was 200 years ago when they were breaking free from European colonialism. Given the vast natural resources of the region, this seems unlikely to change.

What’s important to always remember, however, is what exactly is being traded. Brazil’s top export to China in 2021 was iron ore; its top import was semiconductors. Argentina exports bovine meat to Germany, yet imports motor vehicles.

Latin America’s countries are no longer the territorial or colonial holdings of far-off monarchs in Lisbon, Madrid, or Paris.

If the goal in the long run is to preserve sovereignty and grow economically, then developing domestic industrial and services sectors will be key.

About

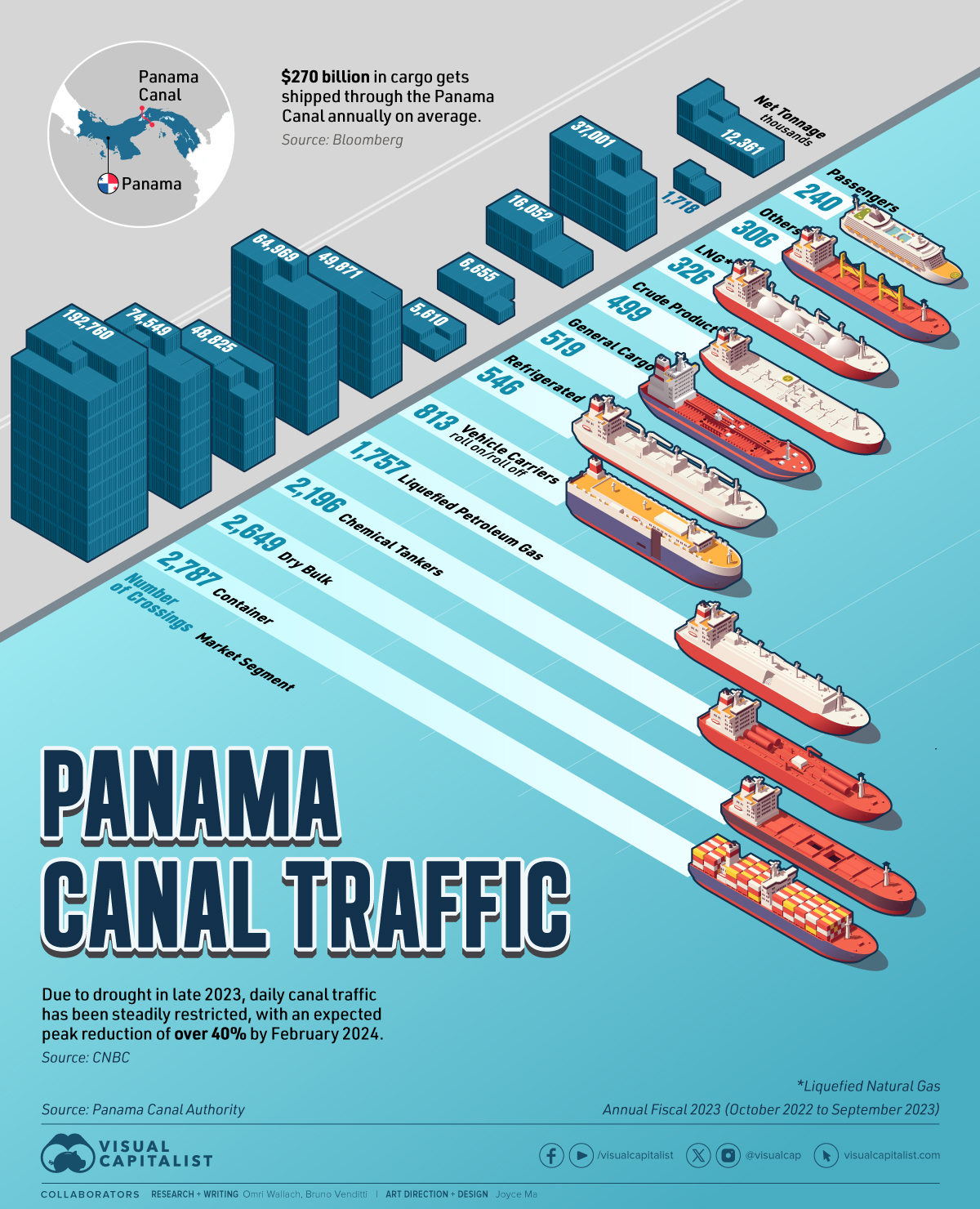

Panama Canal

Panama Canal is an artificial 82-kilometer (51-mile) waterway that connects the Pacific Ocean with the Atlantic Ocean, built between 1904 and 1914.

The Canal locks at each end lift ships to Gatun Lake, an artificial freshwater lake 26 meters (85 ft) above sea level. The shortcut dramatically reduces the time for ships to travel between the two oceans, enabling them to avoid the route around the southernmost tip of South America via the Drake Passage or Strait of Magellan.

Panama Canal moves roughly $270 billion worth of cargo annually–it’s the trade route taken by 40% of all U.S. container traffic alone and handles about 5% of all global maritime trade.

The Driest October in 70 Years

Last October, however, Panama received 41% less rainfall than usual, leading to the driest October in 70 years in what was supposed to be Panama’s rainy season, bringing the level of the Gatun Lake almost six feet below where it was a year ago. Additionally, infrastructure constraints led the Panama Canal Authority to restrict the number of ships that could pass each day.

The principal commodity groups carried through the Canal are motor vehicles, petroleum products, grains, coal, and coke.

| Market Segment | Transits (#) | Net Tonnage (thousands) |

|---|---|---|

| Container | 2,787 | 192,760 |

| Dy Bulk | 2,649 | 74,549 |

| Chemical Tankers | 2,196 | 48,825 |

| Liquefied Petroleum Gas | 1,757 | 64,969 |

| Vehicle Carriers | 813 | 49,871 |

| Refrigerated | 546 | 5,610 |

| General Cargo | 519 | 6,655 |

| Crude Product Tankers | 499 | 16,052 |

| Liquefied Natural Gas | 326 | 37,001 |

| Other | 306 | 1,718 |

| Passengers | 240 | 12,361 |

| Total | 12,638 | 510,370 |

According to the Panama Canal Authority, most of its traffic came from containers and dry bulk like soybeans.

The world’s largest operator of chemical tankers (Stolt-Nielsen) typically also uses the Canal.

However, due to the drought and the backup at the crossing, the operator has decided to reroute its fleet to the Suez Canal.

Although representing the smaller number of crossings, the Canal is also an important route for passengers, with many ocean cruise lines offering popular Panama Canal itineraries that sail through the Canal in the approximately 8-hour passage to their next destination in the opposite ocean.

How Panama canal works

[🎞️ Joe LeMonnier]pic.twitter.com/DRDRf93U8s

— Massimo (@Rainmaker1973) February 17, 2024

Founded in 2017,

Within 6 years of existence, The Brazilian Report has gained international recognition.

It has become the go-to source for several embassies, think tanks, and international news outlets, including Time Magazine, CNBC, BBC Worldwide, Vox, Axios, Radio France, CGTN, among others.

Petrobras wants back in. Jean Paul Prates, the chief executive of Brazilian state-controlled oil and gas giant Petrobras, said this week that the company hopes to reach a deal to regain control of the Mataripe refinery in the northeastern state of Bahia. Read the details

Brazil plans to join the global semiconductor chain. Energy transition is one of the key areas where state-owned firm Ceitec will focus its efforts. But the value that the country is initially willing to invest in this sector is far below investments announced by industry leaders. Read more

A recent survey in seven Latin American countries by Page Interim (a division of human resources giant Michael Page) shows that three out of four Brazilian workers fear being (at least partially) replaced by artificial intelligence.

- The International Monetary Fund recently assessed the potential impact of AI on the global labor market and found that, in most cases, AI is likely to exacerbate overall inequality. Goldman Sachs has previously warned that generative AI could affect as many as 300 million jobs worldwide.

Consider this info for discussion…

#questionsworthasking Which one of these ways work best for you when you embed and transmit culture ?

Source: Edgar Schein via Dr. David Weiss

As we grow and evolve, it can be challenging to influence those who already have a preconceived notion of who we are. People that we know are the hardest audience to persuade because they have already created labels for us based on past experiences. However, if we want to progress in our careers, we must evaluate these labels and determine if they align with our current identity, mission, and purpose.

As leaders, it’s essential to take the time to understand the value that our team members bring beyond our known perceptions. Instead of quick judgments, we should seek to understand their growth, evolution, unique contributions and perspectives. By doing so, we can create a positive work environment filled with creativity and energy that supports everyone’s growth and development.

So, what are the labels you’ve earned? How do people perceive you and talk about you? And, most importantly, are those labels aligned with who you are today? If not, take the necessary steps to bring forward your true identity, support your growth, and magnify your impact in your organization. Remember, you cannot be a prophet in your same town, but you can change the narrative and create a new reality.

#purpose #leadership #identity #intentional #awareness #proactivity