ED COHEN

ED COHEN

EDITORglobalbusinessnews@gmail.com

+1.619.787.3100 WhatsApp

EXPANDED COVERAGE ’26 ON CRITICAL ISSUES FACING US C-SUITES

All U.S. Critical Minerals, Ranked by Supply Disruption Risk

Key Takeaways

- A trade disruption of rhodium from South Africa could cost the U.S. over $64 billion in GDP.

- China is the leading source of 46 of the 84 critical minerals examined by the USGS.

The U.S. relies heavily on imports for dozens of critical minerals used in everything from clean energy to defense. But what happens if those trade flows are disrupted?

This visualization ranks the most economically important critical minerals to the U.S. in 2025, based on potential GDP loss from foreign trade disruptions. The data comes from the U.S. Geological Survey (USGS), and includes 84 critical commodities.

Rhodium Tops the Risk List

A disruption in the supply of rhodium—primarily from South Africa—could slash over $64 billion from U.S. GDP in a single year. That’s more than six times the estimated impact of the next highest-risk mineral, niobium, which is mostly sourced from Brazil. Both materials are key to automotive and aerospace industries.

Rare Earths Carry Broad Economic Exposure

Rare earth elements like samarium, terbium, and dysprosium rank high on the list. These are critical for magnets, motors, and high-tech applications like EVs and wind turbines. China dominates global supply of rare earths, accounting for over 69% of production. This dominance extends beyond mining, with China also processing nearly 90% of the world’s rare earth elements.

The USGS found that China contributes to the GDP risk of 46 of the 84 minerals studied.

Battery Metals and Beyond

Lithium, cobalt, and synthetic graphite—all crucial for battery production—appear lower in absolute dollar terms, but are still vital to long-term energy security. Magnesium, gallium, and germanium also raise red flags due to limited suppliers and essential applications in electronics, defense, and clean tech.

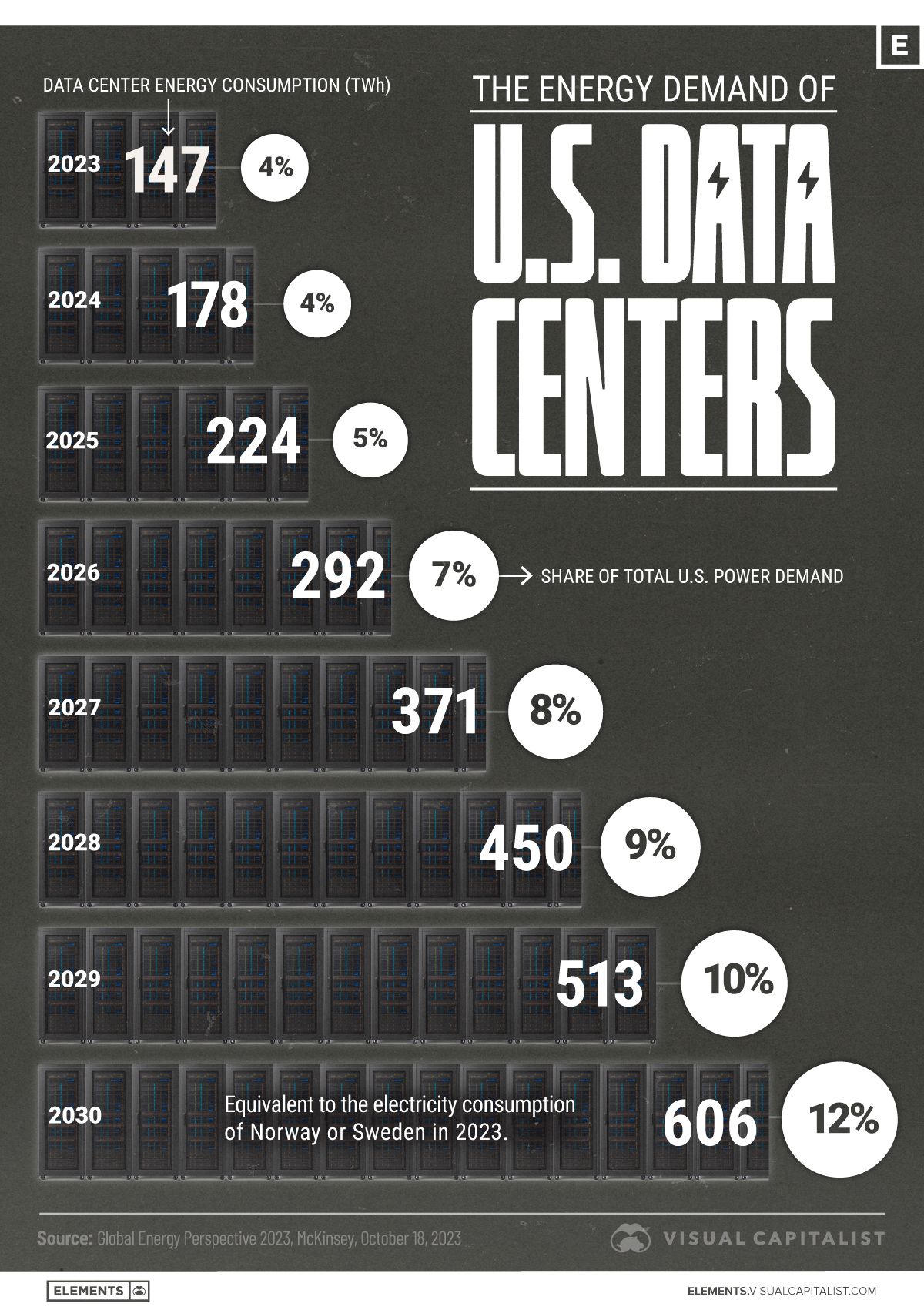

As the digital economy accelerates and generative AI becomes more deeply embedded in business and daily life, the physical infrastructure supporting these technologies is undergoing a transformative explosion.

In this graphic, we use data from McKinsey to show current and projected energy demand from data centers in the United States. Data is from October 2023.

U.S. Data Centers Could Quadruple Power Demand by 2030

Today, data centers account for roughly 4% of total U.S. electricity consumption. But by 2030, that share is projected to rise to 12%, driven by unprecedented growth in computing power, storage needs, and AI model training.

In fact, U.S. data center energy demand is set to jump from 224 terawatt-hours in 2025 to 606 terawatt-hours in 2030.

| Year | Consumption (TWh) | % of Total Power Demand |

|---|---|---|

| 2023 | 147 | 4% |

| 2024 | 178 | 4% |

| 2025 | 224 | 5% |

| 2026 | 292 | 7% |

| 2027 | 371 | 8% |

| 2028 | 450 | 9% |

| 2029 | 513 | 10% |

| 2030 | 606 | 12% |

Meeting this projected demand could require $500 billion in new data center infrastructure, along with a vast expansion of electricity generation, grid capacity, and water-cooling systems. Generative AI alone could require 50–60 GW of additional infrastructure.

This massive investment would also depend on upgrades in permitting, land use, and supply chain logistics. For example, the lead time to power new data centers in large markets such as Northern Virginia can exceed three years. In some cases, lead times for electrical equipment are two years or more.

A Strain on the U.S. Grid

The U.S. has experienced relatively flat power demand since 2007. Models suggest that this stability could be disrupted in the coming years. Data center growth alone could account for 30–40% of all net-new electricity demand through 2030.

Unlike typical power loads, data center demand is constant, dense, and growing exponentially. Facilities often operate 24/7, with little downtime and minimal flexibility to reduce usage.

Conversation with Gemini (11/20/25 10am Pacific)

PLEASE CONTACT ME IF INTERESTED TO SPEAK

PLEASE CONTACT ME IF INTERESTED TO SPEAK

ON THESE IMPORTANT TOPICS;

C-SUITE VIEW AND/OR GLOBALHR VIEW…

TALENT DEVELOPMENT,

US / GLOBAL

COSPONSORS of the CONFERENCE SERIES ARE CORDIALLY INVITED TO BE INVOLVED, BE INTRODUCED

COSPONSORS of the CONFERENCE SERIES ARE CORDIALLY INVITED TO BE INVOLVED, BE INTRODUCED

AND BE INVITED TO SPEAK ABOUT THEIR BRANDS

AND HOW THE BRANDS ARE ASSISTING CORPORATE AMERICA ACHIEVE THEIR OBJECTIVES.

contact Ed the EDITORglobalbusinessnews@gmail.com

Click here to see who and what‘s

now streaming across GLOBAL BUSINESS NEWS-TV

…please SUBSCRIBE FREE to the youtube channel