LatAmGlobal

TVtalkshow date to be announced soon

Foreign Direct Investments + Local

7 California,

9 Mexico City / Texas,

10 Miami / Toronto,

11 Brasil / Argentina

email me

REGISTER FREE

You will receive confirmation + ZOOM-access-link

EDITORglobalbusinessnews@gmail.com

Foreign investment in North America tells a surprising story

about who’s really betting on the continent.

Last month, Latinometrics was in Mexico City for the North Capital Forum, which brought together business leaders, diplomats, policymakers, analysts and much more to discuss the future of North American integration.

Latinometrics Chief Editor moderated a panel entitled Data for Decision-Making which featured a round-table discussion with business leaders from AT&T, GBM, ANPACT, Tule Capital, and Cabrera Capital Markets.

As part of this panel, Latinometrics prepared a number of charts to drive discussion.

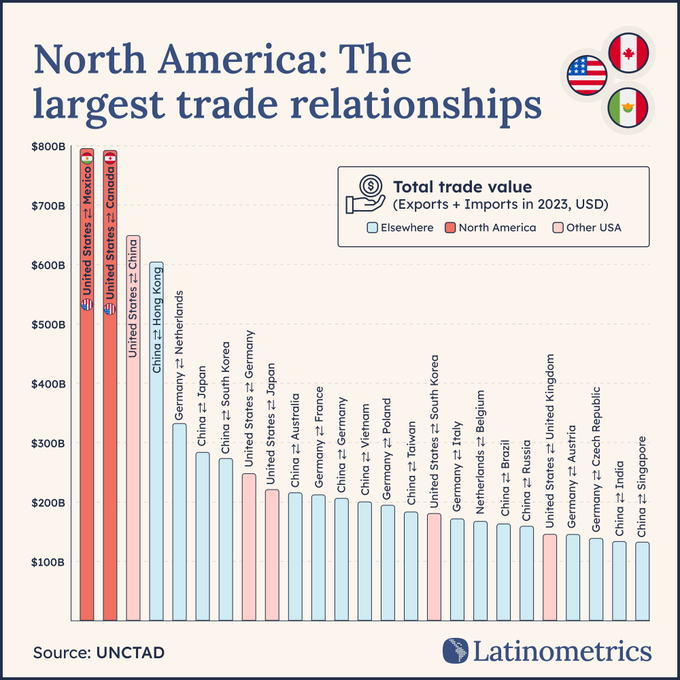

North America is home to the two largest trade relationships worldwide, led by the $800B US-Mexican commercial relationship.

And perhaps no sector better encapsulates this relationship than the automotive industry, which has become a symbol of sorts for North American integration.

To Rogelio Arzate, executive president of Mexican heavy-vehicle association Asociación Nacional de Productores de Autobuses, Camiones y Tractocamiones, A.C. (ANPACT), this industry is facing two main red flags:

A lack of supply chain synchronization across borders, and low credit access to other technologies.

Yet, as Arzate highlights, the sharing of data and growing local content supplies (over Asian imports) offers huge potential for strengthening auto growth.

The latter of these two points, on local content requirements, is how the car industry and others hope to avoid soaring US tariffs.

By ensuring compliance with the United States-Mexico-Canada Agreement, which is due for renegotiation next year, businesses can steer clear of painful trade barriers.

The important thing is getting all sides to recognize the importance.

The USMCA is critical even when domestic politics pretend otherwise, as highlighted by CCM founder and CEO Martin Cabrera:

“The US needs Canada and it needs Mexico to be competitive.

Next year’s renegotiation is about really going in there, getting it done quickly, so we can move forward and continue the growth in all three countries.”

Of course, not all countries have equal leverage.

Mexico is no doubt the country most exposed to the US worldwide, given 80% of its exports head north each year, so tariffs are almost uniquely dangerous. Given this, we asked Miriam Acuña, chief economist at GBM, how markets had evaluated Mexico’s performance vis-à-vis trade tensions.

Acuña noted that investors have tended to reward Mexico’s government for its smooth handling of both domestic and foreign economic matters, as evidenced by the peso’s 10% appreciation this year.

YES… YOUR OPINION MATTERS

YES… YOUR OPINION MATTERS

PLEASE COMMENT ON 1 OR MORE OF THESE CHARTS

HOW DOES THE INFO RELATE TO YOU / YOUR BUSINESS?

I CORDIALLY INVITE YOU TO SPEAK…

Internet Use…

DID YOU KNOW?

More Brazilians use Instagram than live in Mexico or Russia,

but 1 in 10 Latin American adults still lack internet.

source: Latinometrics hola@mail.latinometrics.com

| The 2010s saw Latin America get connected and in a big way.

In just a decade and a half, countries across the region made huge strides in growing connectivity for their citizens, led by private-sector and public-sector cooperation. |

| Today the percentage of Chileans with Internet access is higher than its US counterpart.

Not bad, especially given that in 1995 only 0.04% of the world had (dial-up) Internet access— and over half of those people were living in the United States. |

What is Argentina’s main export?

Argentina’s main exports are agricultural products, with soybeans, wheat, corn, and meat being key commodities.

Other major exports include cereals, soybeans and their byproducts (like soybean meal and oil), and vehicles.

-

Agricultural Products:

Argentina is a leading global exporter of soybeans and wheat. Cereals, animal fodder, and meat are also major exports.

-

Soybean Byproducts:

The country is a major producer of soybean meal and soybean oil, which consistently rank as top exports.

-

Manufactured Goods:

Vehicles (including delivery trucks and cars) are a significant industrial export.

-

Other Exports:

Mineral fuels, crude oil, and steel also contribute to Argentina’s exports.

Argentina primarily EXPORTS industrial supplies and materials, food, feeds, and beverages, and nonmonetary gold to the US.Other exports include agricultural products like beef and soybeans, as well as various chemicals, machinery, and consumer goods.

In 2024, the value of goods was over $7 billion.

Primary imports- Industrial supplies and materials: This includes items like crude and refined petroleum, chemicals, and plastics used in manufacturing processes.

- Industrial supplies and materials: This includes items like crude and refined petroleum, chemicals, and plastics used in manufacturing processes.

-

automotive22.7%

-

technology50%

-

manufacturing22.7%

-

telecommunications4.5%

PANAMA Canal

The economic impacts of the Panama Canal include reduced shipping costs and travel time for global trade, generating substantial revenue for Panama through transit fees and indirect economic activity. The canal is a crucial artery for U.S. trade, with about 14% of U.S. seaborne commerce passing through it, boosting efficiency and creating jobs.

-

Reduced transportation costs:

The canal drastically shortens shipping distances, particularly between the U.S. East and West Coasts and between North America and Europe, leading to lower costs and faster delivery times for goods.

-

Increased trade efficiency:

It has enhanced global commerce by allowing for more efficient and frequent movement of goods through major trade routes, especially connecting North Asia with the U.S. East and Gulf Coasts.

-

Facilitates imports and exports:

The canal is vital for both imports that provide needed products to consumers and exports that support U.S. workers and industries, creating jobs in the process.

-

Revenue generation:

The canal is a significant source of income for Panama, with transit fees contributing billions of dollars to the national treasury each year (approximately $4.3 billion in 2023).

-

Job creation:

Canal operations directly create jobs and generate indirect economic activity through salaries, purchases from local suppliers, and employment in related sectors.

-

GDP contribution:

The canal contributes more than 6% to Panama’s annual GDP when including both direct and indirect economic effects.

-

Ancillary services:

The canal’s operations support other sectors, such as tourism, and provide essential services like potable water to major cities.

-

Supply chain vulnerabilities:

Recent issues like drought have highlighted the canal’s role as a critical choke point in global supply chains, with restrictions leading to higher costs and delays for shipping companies.

-

Strategic importance:Its role in trade and logistics also gives it strategic significance, raising concerns about foreign influence and national security.

Think Latin America only receives investment?

Think again… let’s explore ↓

Every month, in these weekday stories as well as in the pages of the Domingo Brief, we track some of the major investments being made by the world’s largest transnational corporations in Latin America.

Whether carmakers’ big Mexican moves or Telefonica’s recent Andean divestments, we try to ensure you’re up to date on all of the ways in which foreign direct investment (FDI) is powering the region’s economic success stories.

But don’t think for one second that Latin America is merely an investment destination.

Nowadays, led by industry leaders across diverse sectors, regional firms are actually investing abroad.

And while you may not be surprised by the largest Latin American investor…we bet you’ll be surprised by the second-largest.

Yes, while Brazil tops the investor ranking list with nearly $20B in average annual outflows since 2019, Chile is the true success story of Latin America.

The region’s fifth-largest economy has averaged over half of Brazil’s outflows, in the process outpacing larger markets like Argentina, Colombia, and especially Mexico.

A few factors explain this.

To start, Chile’s long history of macroeconomic and political stability have contributed to the country’s economic development, especially relative to the rest of the region.

Neighbors like Argentina or Bolivia have struggled with fiscal discipline or robust legal frameworks, causing decades of lost progress owing to economic volatility and polarization.

Venezuela’s collapse created the worst migration crisis in the Americas, and Colombia absorbed nearly half of 7 million refugees...

Here’s the story ↓

A quarter of a century ago, the idea of millions of people moving to Colombia would no doubt have raised eyebrows.

It was a Colombia recovering from the narco-violence of the early 1990s and still facing both government corruption and FARC-related guerrilla violence.

A Colombia that had seen millions of its own citizens emigrate, especially to the United States, Spain and Venezuela.

In a tragic ironic twist, the last of these countries changed everything for Colombia, a decade ago.

With Venezuela’s descent into economic devastation and government repression under the regime of autocrat Nicolas Maduro, the country has entered the worst migration crisis in the Americas.

Approximately 7M citizens of the Bolivarian Republic have fled abroad in search of work, stability and freedom: a mass exodus largely unparalleled in contemporary peacetime.

Unsurprisingly, nearly half of them have gone to neighboring Colombia, making the country the top destination for migrants in Latin America.

So what happens when the exodus is suddenly reversed?

Like most refugees, most Venezuelans would like to return home when they can. However, its current situation has forced countries in the region to adapt.

For Colombia, a country of just 50M people, the millions of newcomers have implied the need to be proactive.

The Colombian government has established a program to grant legal residency and formalization to Venezuelan migrants, hoping to avoid the kind of administrative and regulatory problems that undocumented immigrants face.

While hosting such a dramatically large immigrant population in a developing country comes with serious challenges, many in Colombia point to the somewhat poetic irony of the situation.

Did you know 42% of Latin Americans still don’t have a credit card in 2023?

Mexico’s changing that fast—let’s explore ↓

In 2018, there were 7.7B credit cards in the world, meaning slightly more cards than human beings on Earth.

Partly this makes sense, especially when you consider that one friend you have who’s overly into finance and who tries to maximize points through nineteen different credit cards.

Yet across much of Latin America, millions of people actually live without the plastic.

s of 2023, a whopping 42% of Latin Americans didn’t have a credit card—which isn’t to say this isn’t slowly changing in countries like Mexico.

In Latin America’s northern giant, the credit card market is booming, and formal banking is on the rise. BBVA and Tarjetas Banamex are leading the charge in the growing financial inclusion of everyday Mexicans.

But who are these cards really built for and how much can they spend?

Most local credit cards are clearly built for everyday purchases rather than big splurges, given that over half have a monthly limit below $1600.

This indicates a market heavily weighted towards the large Mexican middle- and working-class population.

Energy Grid

Energy Grid

Brazil’s 90% green grid and Paraguay’s hydro-power leadership

show LatAm outpaces the US and Europe.

| We live in exciting times.

|

| With all of the negative news swirling around the development world, it’s easy to lose sight of the vast amounts of progress which have been made on a number of fronts.

|

| For example, a decade on from the negotiations of the Paris Climate Accord, there remains much work to do (and there’s widespread agreement that something needs to be done) in powering the green transition and decarbonizing the global economy.

However, one estimate states that over a third – 35%, to be exact – of the world’s electricity generation will come from renewable sources this year. |

| Led by hydroelectric champions like Paraguay and Costa Rica, the region is generating more and more of its electricity from renewable means.

Brazil, by far the largest country in Latin America, has a power grid that is 90% built off green sources, demonstrating that a massive developing economy with both industrial and agricultural might can still lead in the energy transition. |

| Meanwhile, it is worth considering the context: most of Latin America falls ahead of not only the United States by this metric, but even ecological leaders like France and Germany.

While some outliers exist, including most notably Mexico, the fact that most regional countries generate over half of their power through renewable sources is a very good sign. |

| Now, when we say renewable sources, what exactly do we mean? To illustrate, let’s break down Latin America’s energy matrix, putting the green contenders against their fossil-fuel counterparts.

|

watch GLOBAL BUSINESS NEWS… click youtube.com/@globalTVtalkshow