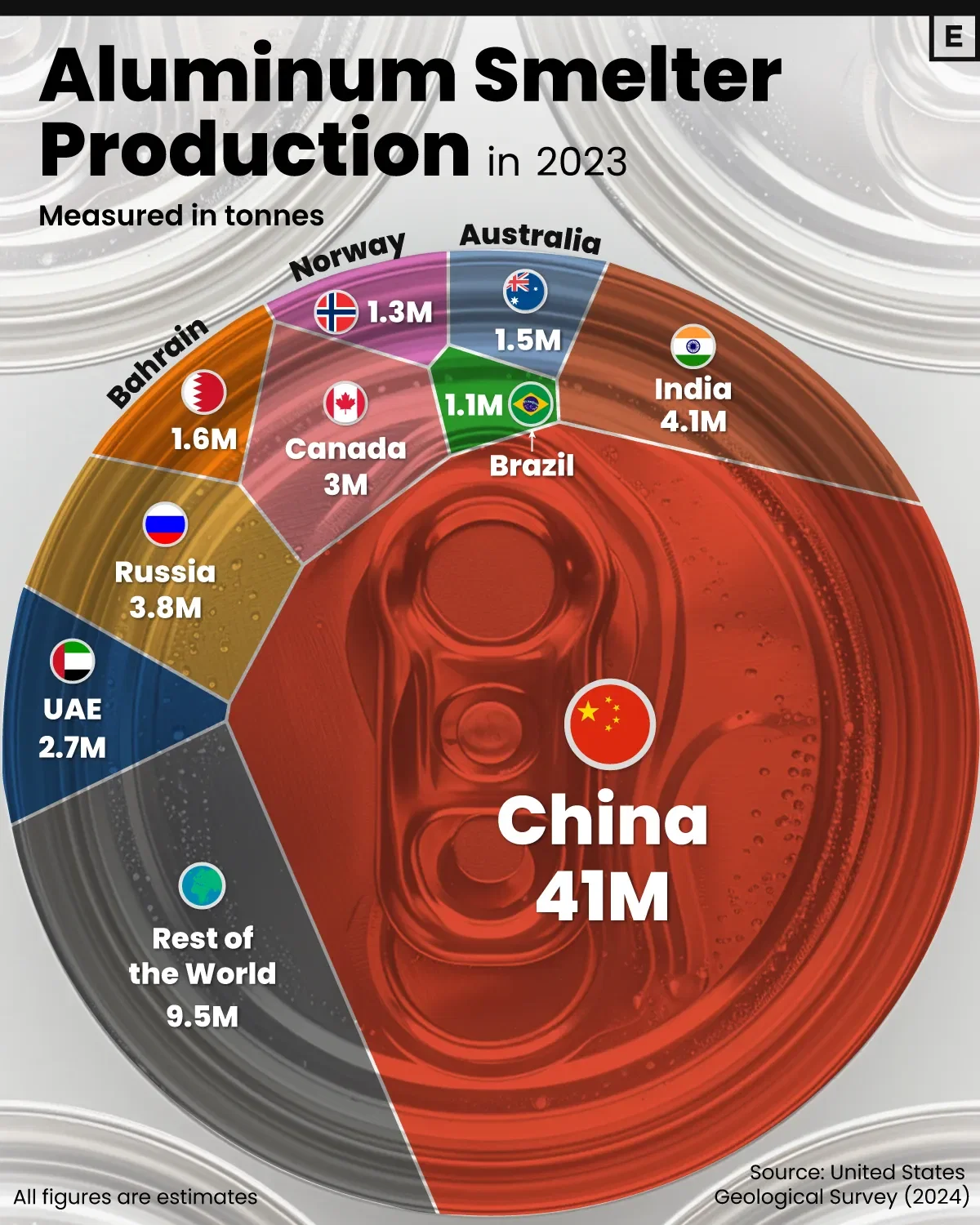

What we’re showing?

Estimated aluminum smelter production by country in 2023.

Key Takeaway

Aluminum, the primary material used for making cans, foil, and many other products, originates from bauxites, rocks composed of aluminum oxides, and various minerals.

China leads as the top producer, accounting for nearly 60% of the world’s smelter capacity. Its neighbor India is the second-largest producer, making only a tenth of China’s output.

Approximately 25% of annually produced aluminum is utilized by the construction industry, while another 23% is allocated to vehicle frames, wires, wheels, and other components within the transportation sector. Aluminum foil, cans, and packaging constitute another significant end-use category, accounting for 17% of consumption.

Dataset

| Country | 2023 Aluminum Smelter Production (tonnes) | % of total |

|---|---|---|

| China | 41,000,000 | 59% |

| India | 4,100,000 | 6% |

| Russia | 3,800,000 | 5% |

| Canada | 3,000,000 | 4% |

| United Arab Emirates | 2,700,000 | 4% |

| Bahrain | 1,600,000 | 2% |

| Australia | 1,500,000 | 2% |

| Norway | 1,300,000 | 2% |

| Brazil | 1,100,000 | 2% |

| Rest of the World | 9,460,000 | 14% |

| Total | 69,560,000 | 100% |

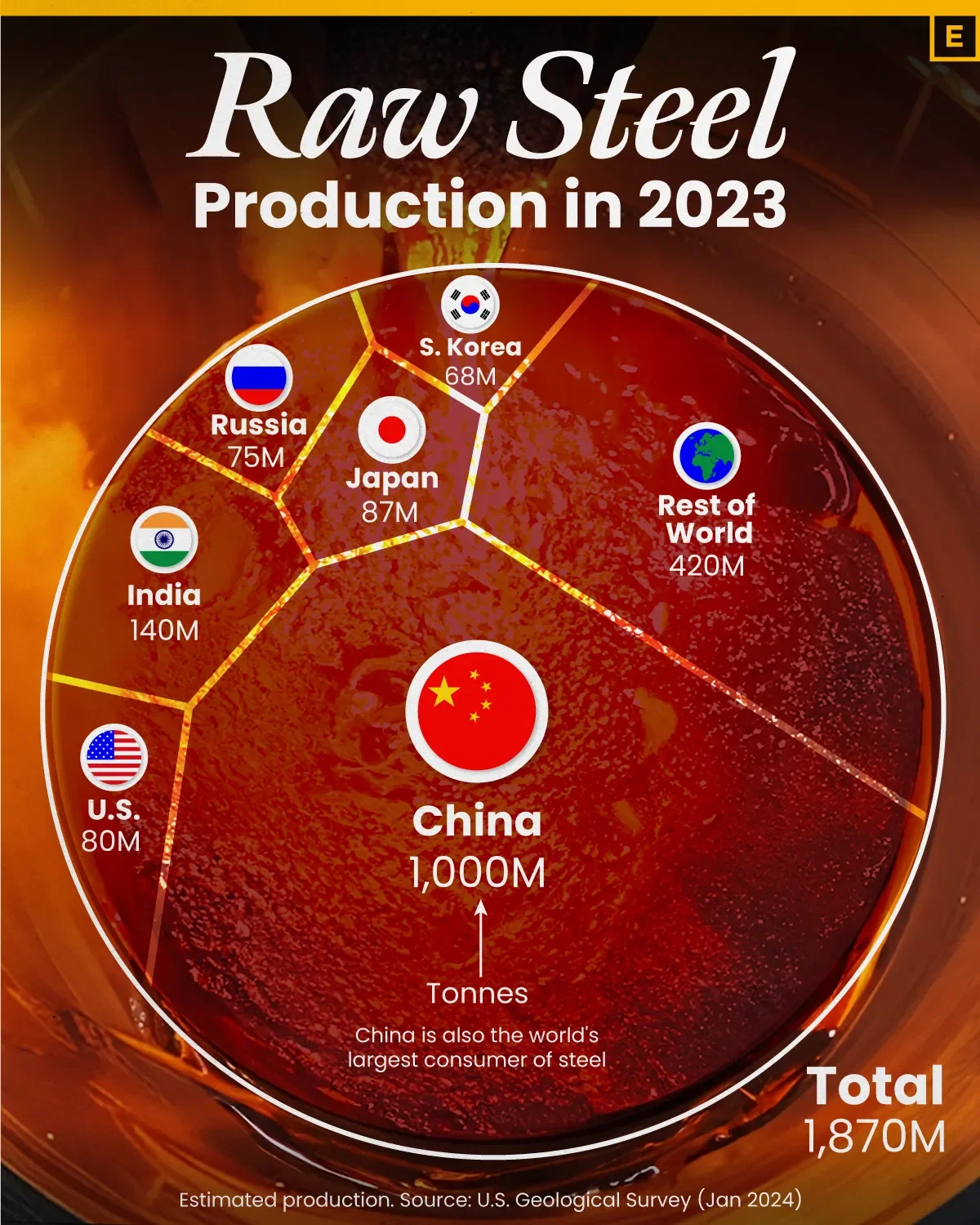

What we’re showing

This graphic breaks down the estimated global production of raw steel in 2023. Data was sourced from U.S. Geological Survey, as of Jan. 2024.

Overcapacity in China

- Steel production in China has outpaced demand in recent years, putting downward pressure on the profit margins of steel mills globally.

- China’s troubled real estate sector has historically accounted for over one-third of the country’s steel consumption.

- The Chinese government has directly required steel production cuts since 2021.

Dataset

| Country | 2023 Production (million tonnes) |

|---|---|

| China | 1,000 |

| Rest of World | 420 |

| India | 140 |

| Japan | 87 |

| U.S. | 80 |

| Russia | 75 |

| S. Korea | 68 |

| Total | 1,870 |

Click here to add your own text

Click here to add your own text